Explain Why the Contribution Margin Differs From the Gross Margin

How to Interpret Gross Margin and Net Margin. A contribution margin income statement differs from the normal income statement preparation in accordance with US GAAP in the following ways.

Contribution Margin Vs Gross Margin Top 6 Differences With Infographics

In this case the difference between gross and net margin is 2017.

. Sales Revenue Variable Expenses Segment margin. Explain how the segment margin differs from the contribution margin. This means that the contribution margin is always higher than the gross margin.

Contribution margins are individual snapshots. From contribution margin figure all fixed expenses are subtracted to obtain net operating income. Generally speaking the contribution margin is most useful as a planning tool in the short run when fixed costs dont change.

Here Gross margin 105808 350519 x 100 3019. Contribution margin is calculated by first establishing the revenue derived from the sales of a particular item next subtracting from that figure all direct production costs associated with that same item then dividing the result by the revenue figure. Fixed production costs are normally aggregated lower in income statement after contribution margin Variable selling and the administrative expenses are grouped with the variable production costs so that they are part of the calculation.

And Net margin 351548 350519 x 100 1002. The gross the operating and the net profit margin are the three main margin analysis measures that are used to intricately analyze the income statement activities of a firm. Net sales of 600000 minus the cost of goods sold of 320000 280000.

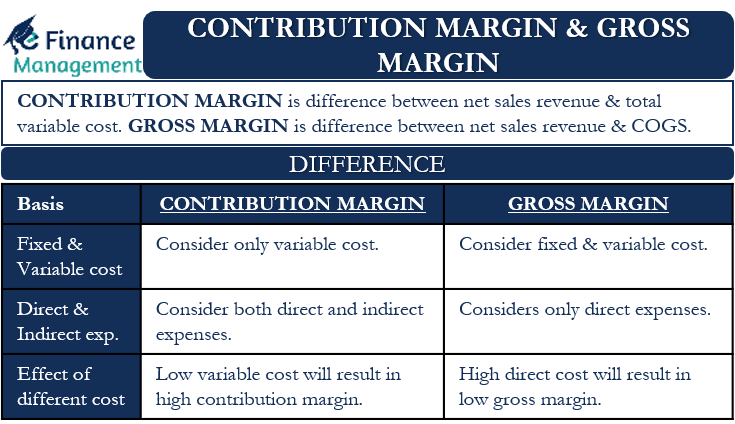

The key difference between Contribution Margin and Gross margin is that Contribution margin is the difference between total sales by the company and its total variable cost which helps in measuring that how efficiently the company is handling its production and maintaining the low levels of the variable costs whereas Gross margin formula is used to know the financial health. It is an important tool to detect the raw material costs for a company in. Gross margin also called gross profit margin represents the percentage of total revenue a company has left over above costs directly related to production and distribution.

It is the difference between a companys sales and variable expenses expressed as a percentage. Learn how they differ. Difference Between Contribution Margin vs Gross Margin The gross margin determines the costs which are associated with the only manufacturer of the product.

The gross margin or gross profit percentage is. Contribution margin is calculating after deducting variable cost it doesnt matter whether that variable cost is direct cost or indirect cost on the other side gross margin is calculating by deducting direct cost from sales it doesnt matter whether that direct cost is variable or fixed. Its one of the best ways to determine the long.

The percentage figure. The companys gross margin is. The segment margin represents the margin still remaining after deducting traceable fixed expenses from the contribution margin.

The difference between sales revenue and variable expenses and is useful as a planning tool for decision making. Both gross and net margins are critical indicators of a businesss profitability and competency in cost management. Example of Contribution Margin.

Segment margin is the margin available after a segment has covered all of its costs. The contribution margin is The variable costs include V while gross margin is The contribution margin the gross margin. Gross profit is your income or sales less cost of goods sold COGS which are all fixed costs above the line on your income statement.

The amount remaining after deducting traceable fixed expenses from the contribution margin and useful in assessing. The following simple formats of two income statements can better explain this difference. Gross profit margin is the gross profit divided by total revenue multiplied by 100 to generate a percentage of income retained as profit after.

Contribution margin analyzes sales less variable costs such as commissions supplies and other back office expenses costs listed below the line on the income statement. Explain why contribution margin per unit becomes. Enter the contribution margin percentage as a percent rounded to two decimal places XXX Contribution margin percentage million 1 million Explain why the contribution margin differs from the gross margin.

Notice that a traditional income statement calculates gross profit and net profit whereas a contribution margin income statement calculates gross contribution. Contribution margin ratio is commonly expressed as a percentage of sales prices. Define the term break-even point.

Explain the difference between the gross margin format and the contribution from COST ACCOU 11 at IE University. Gross profit of 280000 divided by net sales of 600000 467. Ie Contribution Margin Sales Revenue Variable Costs.

The essential difference between the contribution margin and gross margin is that fixed overhead costs are not included in the contribution margin. The segment margin is most useful as a planning tool in the long run when fixed costs will be changing and as a tool. Gross margin is a group photo.

Your net margin differs from gross margin in that it takes into account how much profit you keep after tax for every dollar you generate in revenue while gross margin only takes into account how much profit you keep after subtracting COGS. Net sales of 600000 minus the variable product costs of 120000 and the variable. The companys contribution margin is.

The main difference is that when calculating gross margin the cost of goods sold that is reduced from total revenue can include fixed costs and variable costs whereas the contribution margin is calculated by reducing only variable costs from total revenue. Describe the difference between the units-sold approach to CVP analysis and the sales-revenue approach.

Contribution Margin And Gross Margin Meaning Differences

Contribution Margin Vs Gross Margin 3 Best Difference With Infographics

Difference Between Contribution Margin And Gross Margin Differbetween

Comments

Post a Comment